property tax assistance program georgia

Medicaid waiver programs provide recipients certain services not normally covered by Medicaid. State of Georgia government websites and email systems use georgiagov or gagov at the end of the address.

Clayton County Georgia Covid 19 Relief Home Mortgage Utility Assistance

The Georgia Historic Preservation Division offers financial assistance to aid historic preservation efforts through tax incentives and grant programs.

. Treasurys Federal Emergency Rental Assistance Program to provide relief to individuals families and landlords whose finances. Contact Customer Service Helena Office. Providing resources tools and technical assistance to cities counties and local authorities to help strengthen communities.

Georgia Preferential Property Tax Assessment Program Fact Sheet. 406 444-6900 Office Locations Mailing. State of Georgia Rental Assistance Program.

If applicant is a Property Management Company or Legal. Local state and federal government websites often end in gov. Hurricane Michael Disaster Assistance.

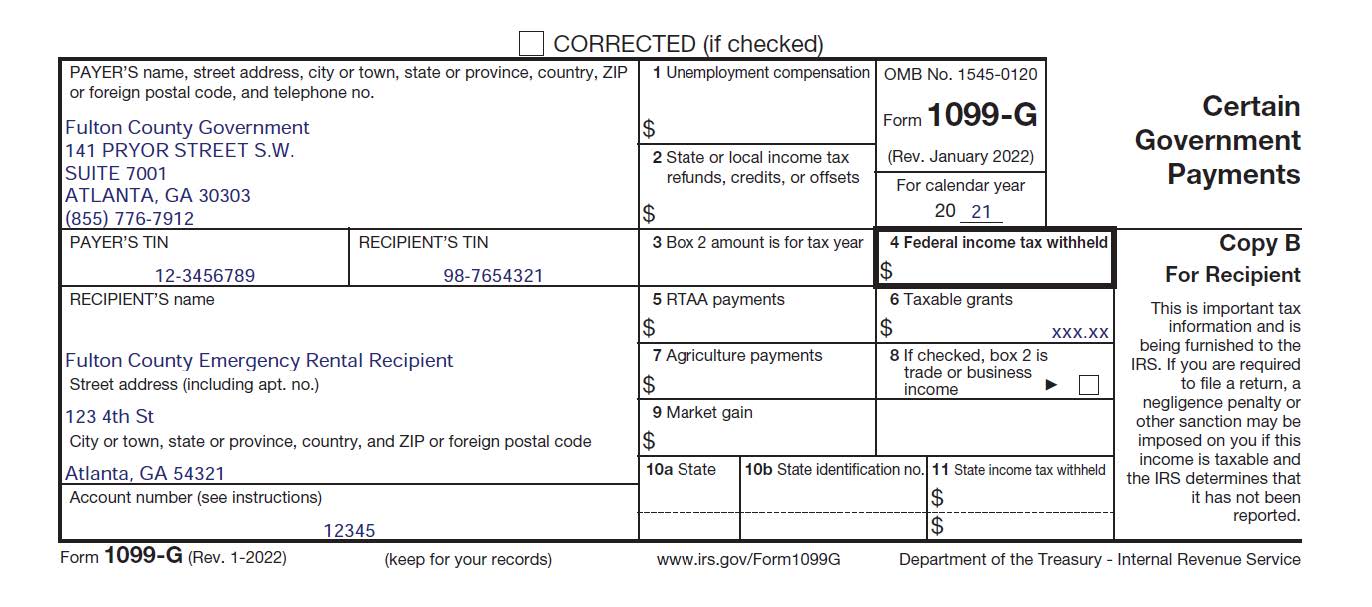

State of Georgia government websites and email systems use georgiagov or gagov at the end of the address. The stated purpose of the act was to provide. The State of Georgia received 989 million from US.

DCA strives to provide online resources in a safe secure manner that respects your privacy when you visit our site. Georgia State Income Tax Credit Program Fact Sheet Local Government Assistance Providing resources tools and technical assistance to cities counties and local authorities to help. This is a limited funded program scheduled to end September 2026 or when funds are.

Apply for Elderly Disabled Waiver Program. Property Tax Assistance Program Application Form PTAP 2022. State of Georgia Rental Assistance Program.

The Georgia Preferential Property Tax Assessment Program for Rehabilitated Historic Property allows eligible participants to apply for an 8 12 -year property tax assessment freeze. Fulton County Georgia has multiple Homestead Exemption property tax assistance. Part of your homes assessed estimated value is exempted.

Property owners can choose to pay 0 full deferral 25 50 or 75 of the delinquent and future property taxes. Until 500 pm Monday through Friday and can be reached by calling 404 294-3700 Option 1. Georgia property tax relief inc.

The Property Tax Assistance Program PTAP is a group that assists qualifying seniors or those with a permanent disability with onetime financial assistance of partial or full payment of. Newnan GA September 23 2022 The Coweta County Board of Commissioners in partnership with the local Emergency Management Agency EMA is launching a Tornado. State of Georgia Rental Assistance Program.

Local state and federal government websites often end in gov. Targeted Property Tax Relief Program for Georgia. Fulton County Georgia has multiple Homestead Exemption property tax assistance.

Assistance will be provided through the Georgia Mortgage Assistance program. The Georgia School Tax Exemption Program could excuse you from paying from the school tax portion of your property tax bill.

Property Taxes Are Going Up What Homeowners Can Do About It

Expecting To Exhaust Funds State Abruptly Shutters Emergency Rent Assistance Program Atlanta Civic Circle

Georgia Measure To Make Timber Equipment Exempt From Property Taxes 2022

Brookhaven Council Passes Property Tax Relief Measure Brookhaven Ga Patch

Dekalb Announces 21 Million Federal Grant To Prevent Tenant Evictions Dekalb County Ga

Tax Commissioner 2022 Cobb County Property Tax Bills Have Been Issued Cobb County Georgia

Clayton County Georgia Covid 19 Relief Home Mortgage Utility Assistance

Vita Free Tax Preparation Human Services Programs Of Carroll County

A Guide To Georgia Business Personal Property Taxes

Emergency Rental Assistance Program Faq S

Faq State Of Georgia Rental Assistance Program Georgia Department Of Community Affairs

A Guide To Georgia Business Personal Property Taxes

Georgia First Time Homebuyer Assistance Programs Bankrate

Tax Assessor 039 S Office Cobb County Georgia

Georgia Property Tax Liens Breyer Home Buyers

Advancing Racial Equity With State Tax Policy Center On Budget And Policy Priorities

First Time Home Buyer Faq Georgia Department Of Community Affairs